Why Do Prices Drop Amidst Inflation?

Tax Reform and Price Competition in Heated Tobacco Products

(Released on November 21, 2023)

Yosuke Yasuda(Professor at the Graduate School of Economics, Osaka University / Co-founder and Principal of Economics Design Inc)

Click here to download

Abstract

The tobacco market is transforming quickly in Japan. Suppliers compete against each other within the combustible cigarette segment and in the newly established market for heating tobacco products (HTP). Recently, price competition is emerging in the HTP market, a phenomenon previously unseen in the HTP field, which is rare in the tobacco market. This paper investigates the reasons behind this newfound competition, identifying the staged implementation of tax reform for HTP until the previous fiscal year as a primary driver. The tax level as well as the tax structure sets the level playing field for this competition. The paper explores how alterations in the tax structure have influenced tobacco companies’ incentives and delves into the implications of price competition on economic welfare and tax revenues.

Introduction: Sudden Price Drops

Over the past several years, the global economy has grappled with rising prices, commonly referred to as inflation. Signs of substantial inflation became noticeable in the Japanese economy approximately a year ago, with recent consumer price increases exceeding 3%.i Amidst this inflationary environment, an unexpected trend has emerged, where one product category is experiencing significant price competition and notable price reductions: heated tobacco products (HTP).

Leading the charge in this price competition was JT (Japan Tobacco Inc.). On March 20, 2023, the company relaunched its “MEVIUS”series for the Plume X heated tobaccoline, significantly reducing the price of eight new brands from 570 yen per pack of 20 cigarettes to 500 yen per pack. Following suit, BAT (British American Tobacco Japan) revised the prices of six brands in its “Lucky Strike”series for its glo hyper heated tobacco on October 1, reducing prices from 450 yen to 400 yen. Both actions represent substantial price reductions, with retail prices dropping by more than 10%.A few other price changes occurred, confirming the phenomenon we observed.BAT’s Kent HTP for glo hyper moved from JPY 500 to JPY 450 per pack as of Aug 1, 2023; At the same moment, BAT’s Neo HTP and Kool HTP (both of which are brands for glo hyper) went from JPY 540 to 500 per pack.

At present, the domestic market for HTP, akin to traditional paper-rolledcigarettes, remains an oligopoly predominantly led by three major companies: JT, BAT, and PM (Philip Morris Japan). JT, holding the smallest market share in the HTP market, was the first to initiate price reductions, followed by BAT, which holds the second-largest market share. PM, the industry giant with a commanding 60-70% HTPs’ market share through its “IQOS” heated tobacco, has not yet made a move to lower its prices. Nevertheless, a price war is already in progress, involving two of the three players. Should PM also decide to reduce prices, it would lead to a full-fledged price war encompassing all three industry giants.

It’s important to recognize that inflation primarily signifies the overall economic condition of rising average prices. Not all products will experience price hikes, and exceptions where prices are reduced would not be uncommon. However, what distinguishesthis scenario is that price competition is unfolding not in a niche market but within the vast tobacco industry, which boasts sales of approximately 5 trillion yen (equivalent to around 140 billion units sold). In the following sections, we will delve into the factors behind this price competition and its ensuing impact.

Two Asymmetries

Beyond market size, there exists another compelling rationale for scrutinizing price competition in the tobacco market, characterized by two pertinent “asymmetries”linked to price reductions. The first of these is the asymmetry between the present and the past. Historically, whether concerning paper-rolled cigarettes or heatedtobacco products, price reductions have been exceedingly rare. Instead, the industry has typically implemented price adjustments that correspond to increases in taxes. In essence, these adjustments involve adding the incremental tax amount to the product price, aligning it with the rise in tax rates.ii

For instance, consider the retail price of Marlboro, which stood at 600 yen per pack in October 2023, exactly half the price it was at 300 yen in 2003, two decades earlier. In the Japanese economy, which has grappled with prolonged price deflation over the years, it is a highly unusual occurrence for a product to double in price within a span of 20 years. What prompts the sudden occurrence of a price reduction in the tobacco market, where price increases have historically been the norm, and why does thisprice reduction coincide with the present time?

Secondly, an asymmetry exists between paper-rolled cigarettes and HTP products. Currently, price competition is exclusive to the HTP market, with no corresponding price reductions observed in the paper-rolledtobacco market for identical cigarette brands. Although the market share dynamics differ, both markets are oligopolies dominated by JT, BAT, and PM, offering closely substitutable goods. So, the question arises: why is price competition only emerging in the HTP sector?

At first glance, it might seem that JT and BAT, each holding relatively modest market shares at present, are aggressively reducing prices to gain a larger foothold in the HTP market.iii However, if the primary motive is to capture market share from their competitors, it begs the question of why similar price competition hasn’t historically occurred in the paper-rolledtobaccomarket, given the fact that theseproductsare substitutes.iv

Considering the two asymmetries, we are prompted to inquire: “Why is there a sudden surge in price competition within the HTP market, previously characterized by price increases as the standard?”Furthermore, “why does this phenomenon exclusively manifest in the HTP market?”These two questions naturally come to the forefront. If there were factors driving this price competition, they should have been absent in the past and currently unique to the HTPmarket. What are these distinguishing factors that could account for this shift?

Tax Reform and Incentives

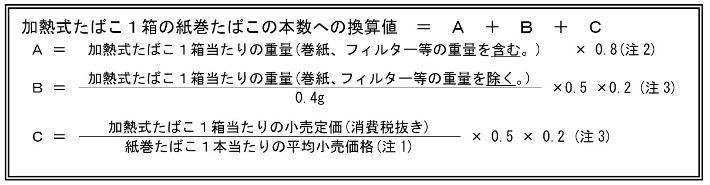

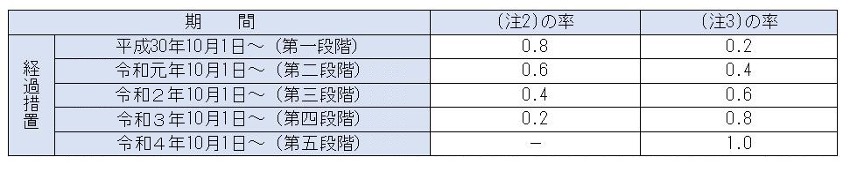

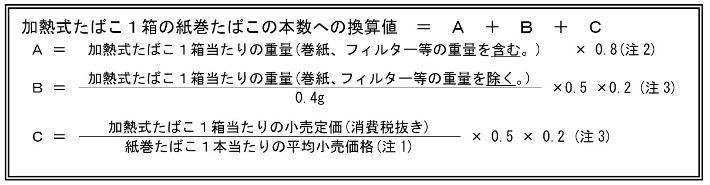

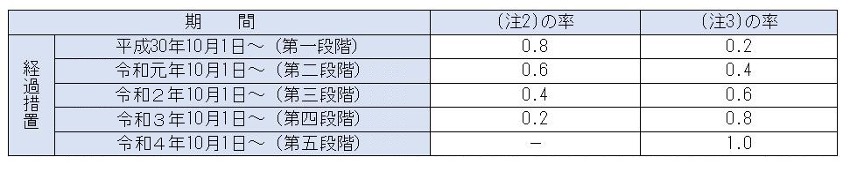

In addressing the two preceding inquiries, we aim to highlight the repercussions of the staggered tax reforms for HTP, which were progressively implemented until 2022. The following formulas and tables have been sourced from the National Tax Agency’s official website.

National Tax Agency, “Revision of Taxation System for Heated Tobacco Products”.

https://www.nta.go.jp/information/other/data/h29/tabacco/03.htm

The tax amount per pack of HTP was previously determined by converting it into the equivalent tax for paper-rolled tobacco. This conversion was based on the weight of each HTP brand, which indicated how many packs of paper-rolledtobaccowere equivalent (referred to as ‘A’ in the table above). However, the recent tax reform has transitioned this tax system from the old approach to a new one, incorporating two factors: weight (‘B’) and price (‘C’). As shown in the table above, this transition occurred incrementally, one year at a time, spanning from 2018 to 2022. In terms of the taxation system, this shift signifies the transformation of the HTP tax from a fully specific excise tax based on product weight to a mixed system with a specific excise tax based on tobacco weight and anad valorem excise tax based on % of retail sales price net of VAT.

Now, the question arises: how has this tax reform altered companies’ricing incentives? To illustrate this, we will employ a simple numerical example to compare the [old method] (unit tax) before the tax reform with the [new method] (hybrid type) implemented after the reform. We will assume a scenario where the weight and other attributes of this brand remain constant, with only changes made to the retail price. To streamline the conversation, we will disregard the presence of consumption tax.

[Old method] (unit tax)←Tax method based on quantity.

Let’s consider a scenario with a unit tax of 300 yen per pack of cigarettes. This taxamount remains constant and is unaffected by the retail price. When the retail price is set at 600 yen, the sales per pack (after tax) amount to 600 yen -300 yen, equaling 300 yen. If the price is decreased to 500 yen, sales will correspondingly decrease to 500 yen -300 yen, resulting in 200 yen. This demonstrates that for every 100 yen reduction in price, sales will decrease by an equivalent amount of 100 yen.

This principle of “price reduction = sales decrease”consistently holds true, irrespective of the specific amount of the unittax in place. From the seller’s perspective, the cost of reducing the price by 1 yen remains the same at 1 yen. This concept remains applicable to products not subject to a unittax as well. It’s important to note that, under the old method, taxation doesnot impact the incentive to lower prices.

[New method] (Hybrid type)←Tax method where price is also used as a criterion.

Under the new method, the tax amount is contingent on the price of HTPs. For instance, when the retail price of a pack of HTPs is set at 600 yen, a tax of 300 yen per pack is levied, comprising a 150 yen unittax and a 150 yen ad valorem tax. Now, if the retail price is reduced to 500 yen, as illustrated in the previous example, what would be the adjusted tax amount? The unittax remains constant at 150 yen. However, the ad valorem tax is recalculated as 150 yen multiplied by the ratio of the price change, which equals 150 yen x (500 yen/600 yen) = 125 yen. It becomes evident that the ad valorem tax decreases by an amount proportional to the price alteration, specifically by 25 yen, equivalent to 1/6 of the price reduction. Consequently, the overall reduction in sales is only 75 yen for a price reduction of 100 yen. The seller is not burdened with 1/4 of the price reduction, as this cost can be offset by the reduction in tax.

This phenomenon of “price reduction > sales decrease”characterizes the ad valorem tax system, thereby providing sellers with a largerincentive than customary to reduce their prices. It’s important to acknowledge, however, that the tax revenue that would have been collected under aunit tax is compromised to the extent of the reduced burden.

The above analysis confirmed how changes in the tax system for HTPaffect sellers. Compared to a quantity-based tax that is neutral to price reductions, an ad valorem tax strengthens incentives for price reductions. The old method imposed a quantity-based tax on heated tobacco, similar to paper cigarettes, but this has now transitioned to a new method that includes an ad valorem tax. The phased transition of this tax system was completed in October of the year 2022. This development might be a significant factor in explaining the mystery of price competition, addressing the questions of “why now”and “why only HTP,”which are linked to the two asymmetries.

Conclusion: Is Price Competition Desirable?

This paper has delved into the underlying factors driving the ongoing price competition in the heated tobacco market. In conclusion, we would like to offer some normative perspectives on whether this price competition is a favorable phenomenon. In economics, price competition is generally regarded as desirable, barring exceptional circumstances.

Notably, across various markets, a decrease in the prices of goods and services enhances the benefits for buyers (referred to as consumer surplus), while simultaneously reducing the profits of sellers (known as producer surplus). If the quantity of goods sold remains unchanged before and after a price reduction, these two effects offset one another. However, price cuts typically stimulate new demand and augment the volume of goods sold. It is well-established that the positive impact of this increased demand results in the positive aspect of consumer surplus outweighing the negative facet of producer surplus, ultimately leading to an enhancement in economic welfare. This is the fundamental reason why price competition is typically perceived as a desirable phenomenon.

However, it’s essential to recognize that cigarette taxes are punitive measures aimed at reducing tobacco consumption, a habit associated with high health risks. In fact, in English, they are often referred to as “sin taxes”due to their association with behaviors considered detrimental. The apparent increase in consumer surplus should not be simplistically viewed as a welfare enhancement. This is because boosting consumption by reducing prices contradicts the primary objective of the tax system, which is to mitigate health risks.v Moreover, the new system enables sellers to transfer a portion of the price reduction to the reduced HTP tax. This deviates from the original intent, allowing sellers to sidestep punitive taxation and bolster demand for products with health risks through price reductions.

Furthermore, there are concerns from the perspective of tax revenue. If the tax burden on sellers diminishes, it implies a reduction in tobacco tax revenues. Presently, the HTP market is only about half the size of the cigarettemarket, and there are relatively few low-priced HTP brands available. However, the market share of heated products is progressively growing annually. If the current tax system remains unaltered, there’s a substantial risk of future declines in tax revenues. While the focus is on augmenting defense expenditures by raising tobacco taxes, it’s crucial to reconsider not only the scope of the tax rate increase but also the taxation system for HTP.

——————————————————————–

i For the rate of increase in consumer prices, see the following newspaper article:

Consumer prices rose 3.1% in August, growth remained flat and remained high.

https://www.nikkei.com/article/DGXZQOUA202BH0Q3A920C2000000/

ii Unlike ordinary goods and services, cigarettes are subject to strict price regulations under the Tobacco Business Law. Specifically, the law mandates the sale of cigarettes at a fixed price (Article 36), and changes in retail prices must be approved by theMinister of Finance (Article 33) in advance.

iii See, for example, the following online article:60% of cigarettes are taxed! Why has the price of heated cigarettes been reduced while cigarette taxes have been increased?

https://financial-field.com/tax/entry-239531

iv One of the reasons why price reductions have not occurred in the cigarette market is the tax structure. Cigarettes have full-specific taxes, while HTPs are fully ad-valorem. Another reason is the very low price elasticity (of demand) of cigarettes. The price elasticity of cigarettes is estimated to be 0.3-0.4, which means that for a 10% price increase, the decrease in demand is extremely small (3-4%). This means that even if the three companies were to uniformly reduce the price of cigarettes by 10%, demandwould increase by only 3-4%. If the benefit of increased demand from a price cut is so small, it is only natural that no one would attempt a price cut. On the other hand, no reliable price elasticity estimates have been published for HTP. If the price elasticity of HTP is much larger than that of cigarettes, it would explain to some extent why HTP are more likely to experience price competition (at least more than paper-rolled tobacco). Conversely, if there is no significant difference in price elasticity between paper-rolled tobacco and HTP, other reasons would be required to explain the asymmetry.

v From the perspective of taxation on health risks, the tax amount should be determined according to the health risk of each brand, regardless of the retail price. In this sense, the old method, in which the tax amount is calculated based on the weight of the content rather than the price, is more in line with the original purpose of taxation. In addition, in the first place, the health impact of paper-rolled tobacco and HTP themselves couldbe significantly differentas the latter is not burnt. Accordingly, risks are not the same.Reflecting such difference, many countries, including the United Kingdom, Germany, and France, have significantly reduced the tax rate on HTP, which are considered to have relatively low health risks, compared to paper-rolled tobacco. See the following newspaper article:Heated cigarettes are considered to have lower health risks, and some overseas countries have tax differences with paper cigarettes.

https://www.sankei.com/article/20230817-KFGAFUDX5ZPCJNHZQC7CP3WSF

Yosuke Yasuda(Professor at the Graduate School of Economics, Osaka University / Co-founder and Principal of Economics Design Inc)

Click here to download

Abstract

The tobacco market is transforming quickly in Japan. Suppliers compete against each other within the combustible cigarette segment and in the newly established market for heating tobacco products (HTP). Recently, price competition is emerging in the HTP market, a phenomenon previously unseen in the HTP field, which is rare in the tobacco market. This paper investigates the reasons behind this newfound competition, identifying the staged implementation of tax reform for HTP until the previous fiscal year as a primary driver. The tax level as well as the tax structure sets the level playing field for this competition. The paper explores how alterations in the tax structure have influenced tobacco companies’ incentives and delves into the implications of price competition on economic welfare and tax revenues.

Introduction: Sudden Price Drops

Over the past several years, the global economy has grappled with rising prices, commonly referred to as inflation. Signs of substantial inflation became noticeable in the Japanese economy approximately a year ago, with recent consumer price increases exceeding 3%.i Amidst this inflationary environment, an unexpected trend has emerged, where one product category is experiencing significant price competition and notable price reductions: heated tobacco products (HTP).

Leading the charge in this price competition was JT (Japan Tobacco Inc.). On March 20, 2023, the company relaunched its “MEVIUS”series for the Plume X heated tobaccoline, significantly reducing the price of eight new brands from 570 yen per pack of 20 cigarettes to 500 yen per pack. Following suit, BAT (British American Tobacco Japan) revised the prices of six brands in its “Lucky Strike”series for its glo hyper heated tobacco on October 1, reducing prices from 450 yen to 400 yen. Both actions represent substantial price reductions, with retail prices dropping by more than 10%.A few other price changes occurred, confirming the phenomenon we observed.BAT’s Kent HTP for glo hyper moved from JPY 500 to JPY 450 per pack as of Aug 1, 2023; At the same moment, BAT’s Neo HTP and Kool HTP (both of which are brands for glo hyper) went from JPY 540 to 500 per pack.

At present, the domestic market for HTP, akin to traditional paper-rolledcigarettes, remains an oligopoly predominantly led by three major companies: JT, BAT, and PM (Philip Morris Japan). JT, holding the smallest market share in the HTP market, was the first to initiate price reductions, followed by BAT, which holds the second-largest market share. PM, the industry giant with a commanding 60-70% HTPs’ market share through its “IQOS” heated tobacco, has not yet made a move to lower its prices. Nevertheless, a price war is already in progress, involving two of the three players. Should PM also decide to reduce prices, it would lead to a full-fledged price war encompassing all three industry giants.

It’s important to recognize that inflation primarily signifies the overall economic condition of rising average prices. Not all products will experience price hikes, and exceptions where prices are reduced would not be uncommon. However, what distinguishesthis scenario is that price competition is unfolding not in a niche market but within the vast tobacco industry, which boasts sales of approximately 5 trillion yen (equivalent to around 140 billion units sold). In the following sections, we will delve into the factors behind this price competition and its ensuing impact.

Two Asymmetries

Beyond market size, there exists another compelling rationale for scrutinizing price competition in the tobacco market, characterized by two pertinent “asymmetries”linked to price reductions. The first of these is the asymmetry between the present and the past. Historically, whether concerning paper-rolled cigarettes or heatedtobacco products, price reductions have been exceedingly rare. Instead, the industry has typically implemented price adjustments that correspond to increases in taxes. In essence, these adjustments involve adding the incremental tax amount to the product price, aligning it with the rise in tax rates.ii

For instance, consider the retail price of Marlboro, which stood at 600 yen per pack in October 2023, exactly half the price it was at 300 yen in 2003, two decades earlier. In the Japanese economy, which has grappled with prolonged price deflation over the years, it is a highly unusual occurrence for a product to double in price within a span of 20 years. What prompts the sudden occurrence of a price reduction in the tobacco market, where price increases have historically been the norm, and why does thisprice reduction coincide with the present time?

Secondly, an asymmetry exists between paper-rolled cigarettes and HTP products. Currently, price competition is exclusive to the HTP market, with no corresponding price reductions observed in the paper-rolledtobacco market for identical cigarette brands. Although the market share dynamics differ, both markets are oligopolies dominated by JT, BAT, and PM, offering closely substitutable goods. So, the question arises: why is price competition only emerging in the HTP sector?

At first glance, it might seem that JT and BAT, each holding relatively modest market shares at present, are aggressively reducing prices to gain a larger foothold in the HTP market.iii However, if the primary motive is to capture market share from their competitors, it begs the question of why similar price competition hasn’t historically occurred in the paper-rolledtobaccomarket, given the fact that theseproductsare substitutes.iv

Considering the two asymmetries, we are prompted to inquire: “Why is there a sudden surge in price competition within the HTP market, previously characterized by price increases as the standard?”Furthermore, “why does this phenomenon exclusively manifest in the HTP market?”These two questions naturally come to the forefront. If there were factors driving this price competition, they should have been absent in the past and currently unique to the HTPmarket. What are these distinguishing factors that could account for this shift?

Tax Reform and Incentives

In addressing the two preceding inquiries, we aim to highlight the repercussions of the staggered tax reforms for HTP, which were progressively implemented until 2022. The following formulas and tables have been sourced from the National Tax Agency’s official website.

National Tax Agency, “Revision of Taxation System for Heated Tobacco Products”.

https://www.nta.go.jp/information/other/data/h29/tabacco/03.htm

The tax amount per pack of HTP was previously determined by converting it into the equivalent tax for paper-rolled tobacco. This conversion was based on the weight of each HTP brand, which indicated how many packs of paper-rolledtobaccowere equivalent (referred to as ‘A’ in the table above). However, the recent tax reform has transitioned this tax system from the old approach to a new one, incorporating two factors: weight (‘B’) and price (‘C’). As shown in the table above, this transition occurred incrementally, one year at a time, spanning from 2018 to 2022. In terms of the taxation system, this shift signifies the transformation of the HTP tax from a fully specific excise tax based on product weight to a mixed system with a specific excise tax based on tobacco weight and anad valorem excise tax based on % of retail sales price net of VAT.

Now, the question arises: how has this tax reform altered companies’ricing incentives? To illustrate this, we will employ a simple numerical example to compare the [old method] (unit tax) before the tax reform with the [new method] (hybrid type) implemented after the reform. We will assume a scenario where the weight and other attributes of this brand remain constant, with only changes made to the retail price. To streamline the conversation, we will disregard the presence of consumption tax.

[Old method] (unit tax)←Tax method based on quantity.

Let’s consider a scenario with a unit tax of 300 yen per pack of cigarettes. This taxamount remains constant and is unaffected by the retail price. When the retail price is set at 600 yen, the sales per pack (after tax) amount to 600 yen -300 yen, equaling 300 yen. If the price is decreased to 500 yen, sales will correspondingly decrease to 500 yen -300 yen, resulting in 200 yen. This demonstrates that for every 100 yen reduction in price, sales will decrease by an equivalent amount of 100 yen.

This principle of “price reduction = sales decrease”consistently holds true, irrespective of the specific amount of the unittax in place. From the seller’s perspective, the cost of reducing the price by 1 yen remains the same at 1 yen. This concept remains applicable to products not subject to a unittax as well. It’s important to note that, under the old method, taxation doesnot impact the incentive to lower prices.

[New method] (Hybrid type)←Tax method where price is also used as a criterion.

Under the new method, the tax amount is contingent on the price of HTPs. For instance, when the retail price of a pack of HTPs is set at 600 yen, a tax of 300 yen per pack is levied, comprising a 150 yen unittax and a 150 yen ad valorem tax. Now, if the retail price is reduced to 500 yen, as illustrated in the previous example, what would be the adjusted tax amount? The unittax remains constant at 150 yen. However, the ad valorem tax is recalculated as 150 yen multiplied by the ratio of the price change, which equals 150 yen x (500 yen/600 yen) = 125 yen. It becomes evident that the ad valorem tax decreases by an amount proportional to the price alteration, specifically by 25 yen, equivalent to 1/6 of the price reduction. Consequently, the overall reduction in sales is only 75 yen for a price reduction of 100 yen. The seller is not burdened with 1/4 of the price reduction, as this cost can be offset by the reduction in tax.

This phenomenon of “price reduction > sales decrease”characterizes the ad valorem tax system, thereby providing sellers with a largerincentive than customary to reduce their prices. It’s important to acknowledge, however, that the tax revenue that would have been collected under aunit tax is compromised to the extent of the reduced burden.

The above analysis confirmed how changes in the tax system for HTPaffect sellers. Compared to a quantity-based tax that is neutral to price reductions, an ad valorem tax strengthens incentives for price reductions. The old method imposed a quantity-based tax on heated tobacco, similar to paper cigarettes, but this has now transitioned to a new method that includes an ad valorem tax. The phased transition of this tax system was completed in October of the year 2022. This development might be a significant factor in explaining the mystery of price competition, addressing the questions of “why now”and “why only HTP,”which are linked to the two asymmetries.

Conclusion: Is Price Competition Desirable?

This paper has delved into the underlying factors driving the ongoing price competition in the heated tobacco market. In conclusion, we would like to offer some normative perspectives on whether this price competition is a favorable phenomenon. In economics, price competition is generally regarded as desirable, barring exceptional circumstances.

Notably, across various markets, a decrease in the prices of goods and services enhances the benefits for buyers (referred to as consumer surplus), while simultaneously reducing the profits of sellers (known as producer surplus). If the quantity of goods sold remains unchanged before and after a price reduction, these two effects offset one another. However, price cuts typically stimulate new demand and augment the volume of goods sold. It is well-established that the positive impact of this increased demand results in the positive aspect of consumer surplus outweighing the negative facet of producer surplus, ultimately leading to an enhancement in economic welfare. This is the fundamental reason why price competition is typically perceived as a desirable phenomenon.

However, it’s essential to recognize that cigarette taxes are punitive measures aimed at reducing tobacco consumption, a habit associated with high health risks. In fact, in English, they are often referred to as “sin taxes”due to their association with behaviors considered detrimental. The apparent increase in consumer surplus should not be simplistically viewed as a welfare enhancement. This is because boosting consumption by reducing prices contradicts the primary objective of the tax system, which is to mitigate health risks.v Moreover, the new system enables sellers to transfer a portion of the price reduction to the reduced HTP tax. This deviates from the original intent, allowing sellers to sidestep punitive taxation and bolster demand for products with health risks through price reductions.

Furthermore, there are concerns from the perspective of tax revenue. If the tax burden on sellers diminishes, it implies a reduction in tobacco tax revenues. Presently, the HTP market is only about half the size of the cigarettemarket, and there are relatively few low-priced HTP brands available. However, the market share of heated products is progressively growing annually. If the current tax system remains unaltered, there’s a substantial risk of future declines in tax revenues. While the focus is on augmenting defense expenditures by raising tobacco taxes, it’s crucial to reconsider not only the scope of the tax rate increase but also the taxation system for HTP.

——————————————————————–

i For the rate of increase in consumer prices, see the following newspaper article:

Consumer prices rose 3.1% in August, growth remained flat and remained high.

https://www.nikkei.com/article/DGXZQOUA202BH0Q3A920C2000000/

ii Unlike ordinary goods and services, cigarettes are subject to strict price regulations under the Tobacco Business Law. Specifically, the law mandates the sale of cigarettes at a fixed price (Article 36), and changes in retail prices must be approved by theMinister of Finance (Article 33) in advance.

iii See, for example, the following online article:60% of cigarettes are taxed! Why has the price of heated cigarettes been reduced while cigarette taxes have been increased?

https://financial-field.com/tax/entry-239531

iv One of the reasons why price reductions have not occurred in the cigarette market is the tax structure. Cigarettes have full-specific taxes, while HTPs are fully ad-valorem. Another reason is the very low price elasticity (of demand) of cigarettes. The price elasticity of cigarettes is estimated to be 0.3-0.4, which means that for a 10% price increase, the decrease in demand is extremely small (3-4%). This means that even if the three companies were to uniformly reduce the price of cigarettes by 10%, demandwould increase by only 3-4%. If the benefit of increased demand from a price cut is so small, it is only natural that no one would attempt a price cut. On the other hand, no reliable price elasticity estimates have been published for HTP. If the price elasticity of HTP is much larger than that of cigarettes, it would explain to some extent why HTP are more likely to experience price competition (at least more than paper-rolled tobacco). Conversely, if there is no significant difference in price elasticity between paper-rolled tobacco and HTP, other reasons would be required to explain the asymmetry.

v From the perspective of taxation on health risks, the tax amount should be determined according to the health risk of each brand, regardless of the retail price. In this sense, the old method, in which the tax amount is calculated based on the weight of the content rather than the price, is more in line with the original purpose of taxation. In addition, in the first place, the health impact of paper-rolled tobacco and HTP themselves couldbe significantly differentas the latter is not burnt. Accordingly, risks are not the same.Reflecting such difference, many countries, including the United Kingdom, Germany, and France, have significantly reduced the tax rate on HTP, which are considered to have relatively low health risks, compared to paper-rolled tobacco. See the following newspaper article:Heated cigarettes are considered to have lower health risks, and some overseas countries have tax differences with paper cigarettes.

https://www.sankei.com/article/20230817-KFGAFUDX5ZPCJNHZQC7CP3WSF